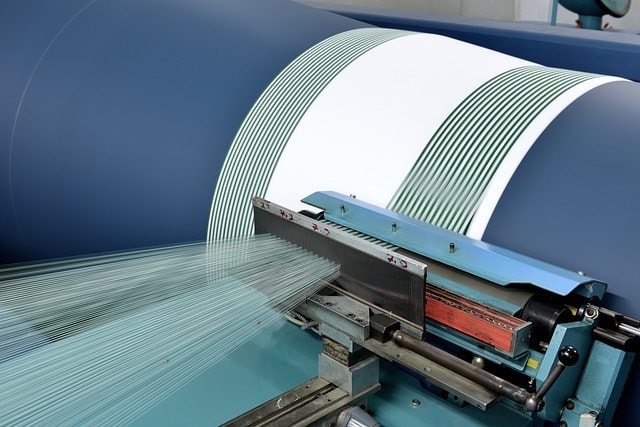

A machinery loan is a small business loan that is availed to finance the cost of equipment. Companies operating in the domain of manufacturing, construction, food processing and others require commercial-grade equipment for running their operations efficiently.

Many startups are on a shoestring budget and often find it difficult to invest in expensive machinery.

A machinery or equipment loan helps them to borrow money for the purchase of advanced machinery, at a low interest rate.

In this article, we are going to discuss the advantages of availing machinery loan, the main lenders and general requirements of getting such a loan.

Advantages of taking a machinery loan

There are several advantages of availing a machinery or equipment loan.

Startups can afford the machinery

Commercial or heavy machinery is expensive, and many small businesses can’t afford to purchase them. Even if they have surplus funds, paying up-front for such equipment will choke their cash flows.

A machinery loan allows very small businesses to buy the machinery, start the production and repay the loan over a period of time.

Competitive interest rates

Machinery loan is readily available in the market at competitive interest rates. Equipment loans have affordable rates compared to other types of loans because lenders get the lien on the purchased equipment. Hence, this classifies under the secured form of lending and has lower interest rates than unsecured lending.

A comfortable time period for repayment

Most of the lenders give between three to five years for the repayment of the machinery loan.

Business can easily repay the loan from cash flows of their operations over several years.

Therefore, the company should evaluate the impact the equipment will have on its cash flow in a detailed manner. You should consider the initial cost of equipment, interest cost of the loan and operating expenses of the machinery to be sure you can pay for everything.

Tax incentives

Equipment loan also gives tax incentives to the business. The profit of the company decreases by the extent of the interest expense on loan, and thereby the business is liable to pay lesser taxes to that extent.

Editor’s note: Don’t have a website yet? Today, if your business is not online, it’s invisible to customers. Get a mobile-friendly WordPress website now with GoDaddy.

Major lenders in India

Many private sector Non-Banking Financial Companies (NBFCs) and banks offer equipment financing loans. Healthy competition in the market can lead to better rates and terms for businesses.

State Bank of India

India’s largest public sector bank offers multiple loans for the purchase of equipment/machinery to small businesses. These include:

- Medical Equipment Finance, a term loan for medical practitioners.

- Cotton Ginning Plus is available for companies operating in cotton ginning for purchase and modernization of machinery.

The Simplified Small Business Loan is for businesses operating for over five years.

- Fleet Finance is designed for fleet operators with minimum existing fleets of 10 vehicles to finance new vehicles.

Government loans

The Government of India (GoI) is also supporting small businesses to modernize and expand with new machinery. Some of the major GoI schemes and initiatives for equipment finance include:

Stand-Up India

Stand-Up India offers various options for purchase and upgrade of equipment for small businesses.

- Through various government-backed financing institutions, Technology Upgradation Fund Scheme provides a capital subsidy for textile and jute industry to facilitate induction of advanced technology.

- The Scheme for Technology Upgradation/Establishment Modernization for Food Processing Industries supports startup, expansion and modernization of food processing units. These grants cover up to 25% of the cost of plant, machinery and civil work.

- Integrated Development of Leather Sector scheme supports the modernization of existing tanneries, footwear and leather product units. The scheme covers the partial cost of plant & machinery.

- The Ministry of Food Processing Industry provides financial assistance for small business for the cold chain, for storage, processing and transport infrastructure. The grant covers the partial cost of the project and is released in three instalments of 25%, 40% and 35%.

- Scheme for Extension of Financial Assistance for Generator Set/Diesel Engine provides funds for the purchase of generator set to fibre/curled coir production units. This enables them to produce during power cuts.

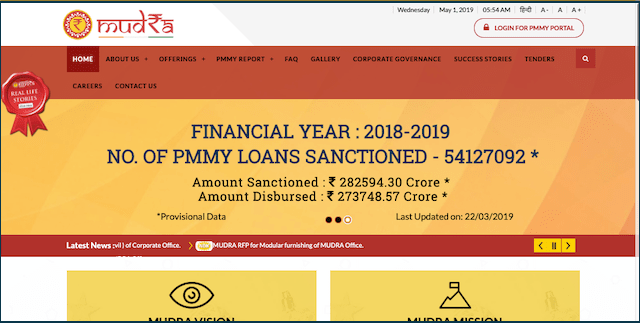

Pradhan Mantri MUDRA Yojna

Micro Units Development and Refinance Agency Ltd. (MUDRA) is an NBFC supporting the development of the small/micro sector in India. It extends loans through several channels including:

- Private/public sector banks

- Micro-finance institutions

- Regional rural banks

- Schedules cooperative banks etc.

Mudra loan is extended for a variety of purposes, including equipment finance for micro-units, purchase of transport vehicles and other business loans.

PSB Loans in 59 Minutes

GoI offers a dedicated digital platform to enable loans for micro, small and medium enterprises in just 59 minutes.

PSB Loans take around seven to eight working days to disburse the funds.

You simply need to submit the documents online and the portal connects you with one amongst several partner banks including SBI, Bank of Baroda, Punjab National bank, Vijaya Bank and others.

General requirements of lenders

Businesses that apply for an equipment loan should be in existence from last two to three years. Loan applicants will be required to submit the following:

- Last year’s bank account statements of the company

- All relevant incorporation and Know Your Customer documents

- Filed ITR returns of last two to three years

- Financial account statements from last two to three years

- Details of collateral security and equipment being purchased, including valuations

There might also be a margin requirement whereby the business contributes 10 to 25% of the cost of the machinery and lenders finance the remaining.

Conclusion

Machinery loans offer various advantages as discussed above, but it is the responsibility of the business owner to utilize them effectively.

If possible, try to start your business in the absence of the machinery or with basic necessary machinery. Once the product is accepted in the market, you can go ahead for upgradations. A company should evaluate the additional cash flows that the machinery can get for them and take their decisions accordingly.

The information contained in this blog post is provided for informational purposes only, and should not be construed as an endorsement or advice from GoDaddy on any subject matter.